Select your called for lending amount and also tenor to obtain immediate authorization.

No hidden surprises-- set rate lending, no established or admin fees. Evidence of possession of either the home or service facilities. Exclusive evidence can be legitimate in the name of the business person or the name of any kind of blood loved one of the businessman. Any kind of company needs cash periodically to run its organization. Sometimes it takes place that because of the business person's cash getting embeded the marketplace, there is not enough cash offered to the businessman. Between Term Loans as well as Full-Flexi Loans, some financial institutions offer a better rates of interest for a Term Financing.

Under versatile finances, the banks pre-approves your funding amount. The authorized amount is deposited into your funding account and also you are complimentary to withdraw the funds whenever you require them-- as long as you stay within the credit limit. Under flexi individual car loan, you can utilize the amount for any type of genuine objective, and the loan provider calculates the rate of interest only on the quantity that you have taken out from your financing account. The quantity that you have not made use of does not accumulate any interest. In India, both salaried and also self-employed individuals can get flexi individual lendings.

Flexi funding plays an essential duty in making the loan special. There are numerous sorts of centers offered to pay off a Flexi funding. In this, it is feasible if the client wishes to just pay the rate of interest in the initial EMI and pay the primary quantity later. The passion estimations for property fundings comply with that of the reducing equilibrium approach. Every time your instalments are paid, a part of it goes in the direction of servicing the passion, while the remainder goes in the direction of paying down the primary quantity owed.

A flexi loan is usually advised if you are expecting a constant increase in revenue soon. Under this strategy, you can progressively enhance your EMI quantity based upon yourcash inflow. A conventional individual funding plan is a much better choice for those that have a secure earnings. This details is basic in nature and also has been prepared without taking your goals, demands as well as overall monetary circumstance right into account. Consequently, you should take into consideration the relevance of the details to your own conditions and also, if necessary, look for proper professional suggestions. Please consider your specific situations prior to obtaining a Westpac Personal Car Loan.

- Nonetheless, if you desire to pay your due utilizing the funds from your account, you have to withdraw it initially after that pay face to face at any type of Westpac branch.

- In addition to that, you can manage your funds conveniently by means of ATM, electronic banking, DuitNow, JomPay and also a lot more.

- Finder's choice to reveal a 'advertised' product is neither a referral that the item is ideal for you neither a sign that the item is the best in its category.

- While our site will supply you with factual information and also general recommendations to help you make much better decisions, it isn't a substitute for professional guidance.

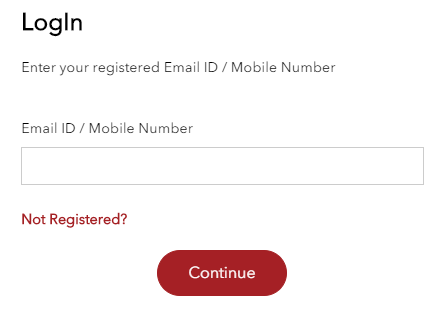

You can just transact online, and also borrow as well as deposit funds, through our client site-- Experia. Supplying or getting an approximated insurance coverage quote via us does not ensure you can get the insurance. Acceptance by insurance provider is based on points like profession, health and wellness and also way of life. By supplying you with the capacity to make an application for a charge card or car loan, we are not assuring that your application will certainly be authorized. Your application for credit scores items undergoes the Carrier's terms in addition to their application and also loaning requirements.

Head to CreditSmart.org.auand adhere to the links to a free credit rating record. Transfer funds from your Flexi Finance account to a purchase account or pay costs straight using BPAY ®. A continuous credit line facility you can access when you need to, without needing to reapply. You obtain the versatility to pay the impressive financing quantity as and when you intend to pay, however you need to pay the rate of interest every month.

Flexi Funding Vs Term Funding

Just in instance of a term funding, the whole financing quantity is disbursed in one go and also you pay rate of interest on an equivalent. The private funding EMI on term lending will include the principal and also rate of interest amount. Obtain from $5,000 to $55,000, with 1 years to 7 years financing terms readily available.

Benefits Of Flexi Loans

Additionally, when you add additional funds right into this bank account, this will reduce your residential or commercial property car loan rate of interest. The rate of interest charged on flexi individual financings ranges between 13.99%- 15.25%. Presently, Tata Resources offers the most affordable flexi finance to name a few leading lending institution offering this lending. Individual Financing-- The tone for a personal funding is a set payment duration during which the due quantity should be settled in EMIs. Several NBFCs and also financial institutions supply flexible tenor on such car loans. The rate of interest is charged on the major amount as well as split throughout the tone, and also the amount in EMIs.

Initially, Lets Understand The Concepts Behind The Fundamental Term Finance As Well As Interest Computations For Residential Or Commercial Property Lendings

After get the car loan, it depends on you on exactly how you intend to spend the financing amount. Banks like ICICI Financial institution provides Flexi-Cash center, which is just created for ICICI Financial institution salary consumers. Utilize our client site-- Experia, to move funds from your funding restriction to your lending account and also make early repayments. You can access your account 24/7 via electronic banking or telephone banking to make settlements or withdrawals. Crossbreed Flexi Finance-- When it comes to a hybrid Flexi loan, the debtor receives the finance for a taken care of restriction.